Lets map the Yield spread of 10Y and 2Y government bonds of the US Government. The theory goes that when 2Y yield is more than the 10Y the spread turns negative indicating that people are ditching the short term protection of the bond market and jumping into risky assets, it also indicates that if interest rates are rising in the short-term a better return might be sought elsewhere.

However when that reverses, the 10Y yields are more than the 2Y yields; people are either jumping in the short-term bills as a safety measure driving up demand and suppressing the yields on the 2Y or people are not interested in holding longer-term bonds due to some uncertainties.

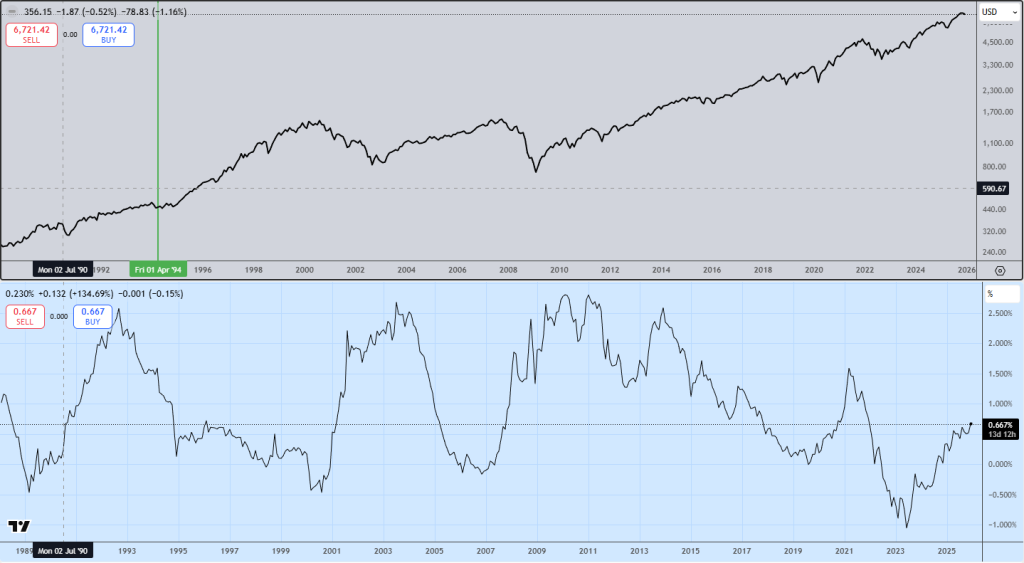

Lets keep this jargon aside and lets look what the charts are saying, and map it since the late 1980’s.

March 1989 – The yield spread is negative (-0.46%) and by June 1990 the spread seem to be reverting back to “normal” with SPX showing sideways to upward bias. However in the following months by Oct 1990 the spread is quickly gone up to 0.9% putting a downward pressure on SPX (-15%). The spread continues to rise (at high of 2.6% by Sept 1992), however the SPX rises with it at much slower pace than previous rallies. The pace of SPX picks up when the spread falls back to 0.12%.

August 2000 – The yield spread again falls to a low of -0.46% which has fueled much of the rally since late 1994. Dot com bubble or not, relationship is there. Yield spread negative and turning along with SPX topping out. Here moves are in-sync unlike the 1989. As the Spread increases (turns positive) the SPX treks downward. First spread expands to roughly 2% and then chops about. SPX bottoms after giving up 45%. The spread continues to expand and so does SPX. Similar to what seem to have happened in 1990’s.

November 2006 – The spread hit a bottom of -0.16% the initial days of stress in the Mortgage Market in the US, however the broader market seems to shrug it off till it can’t. Interestingly the pain is not felt until October 2007 when the spread has turned positive and crossed 0.6%. The markets bottoms in Feb 2009 with the spread around 1.9%. Similar story the spread continues to chop up along with the SPX. The spread tops around 2.8% in Feb 2010 with SPX retracing 61% of its fall.

August 2019 – This time around the spread barely falls below 0% and starts rising, by December 2019 the markets are topping out with the spread at 0.35%. Not much can be drawn from this experience because of the Covid-19 pandemic. But here in India the stress was visible since 2018 in the boarder markets.

June 2023 – Which brings us to the mother of all yield curve inversion, where the spread reached -1%. This is unlike any previous time as the spread has been trying to go back above, the markets have continued to rally. Which we saw in 1989 and 2007. But the margin with which the markets have rallied is significantly higher than the previous time.

Some have used this to say history never repeats itself or something else is happening this time around. But if you look closer to 2007/8 you will see that it was this moment when the spreads crossed the 0.6% mark is when the stresses were visible in the stock market.

While it is important to note the participants are expecting a 75 basis reduction next year in the Fed Fund Rate, hence the depression of the 02Y yields and 10Y yields are not so excited about it – it could mean three things either the 75 basis does not come along, if it does it is quickly reversed due to inflationary pressures or if the government is monetizing the debt, the longer dated participants are seeking premium against it. Either way whatever the reasoning, it would be interesting to see what happens. Does history repeat or the correlation breaks?

If the correlation remains we would want to see SPX weakness till the spread hits about 2% and then bottoms out. I have seen some reports on automotive segment being in a lot of stress with high debt among consumers and not a rosy picture of the segment. But then again, I am not here to weave stories – I just look at data and patterns.

Leave a Reply

You must be logged in to post a comment.